Introduction to Ponzi Schemes

Ponzi schemes epitomize a quintessential form of investment deception, cleverly disguised as legitimate ventures while covertly diverting funds from unwitting participants. Dubbed after the notorious Charles Ponzi, who orchestrated such a swindle in the early 1900s, these shrewd operations promise astronomical returns with minimal to no risk—a tempting offer that ensnares gullible investors. Essentially, these scams rely on a continuous influx of capital from new investors to provide payouts to earlier ones, creating a façade of success and prosperity. This fragile model endures until new investments dwindle, instigating a chain reaction of financial ruin in its wake.

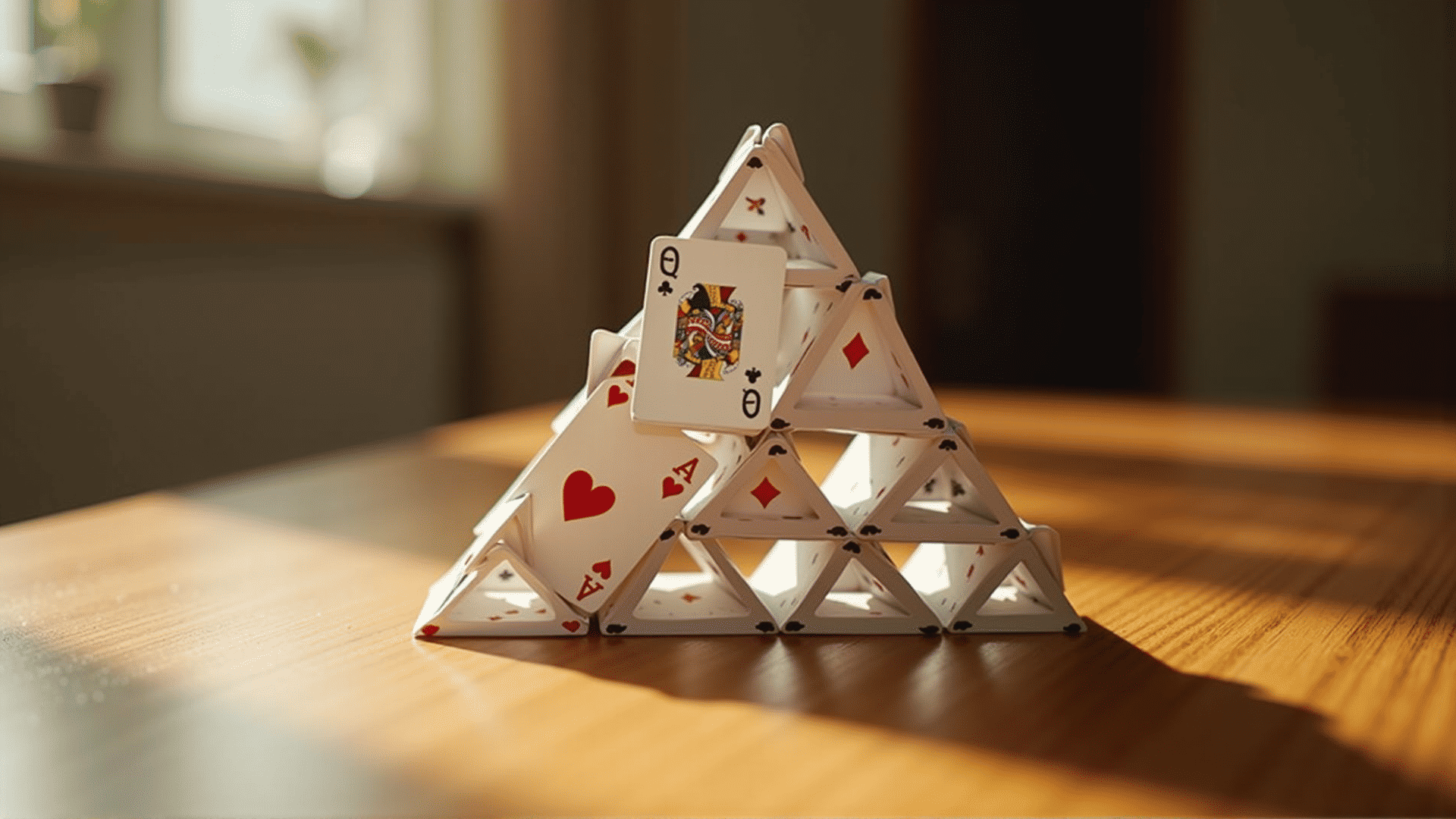

The deceit at the core of Ponzi schemes is typically camouflaged in a veneer of legitimacy, often bolstered by charismatic leaders and seemingly credible documents. As long as a sufficient number of new investors are drawn in by the allure of quick riches, the scheme maintains an aura of authenticity. However, no real profit-generating activities support these scams; they are fragile constructs ready to implode.

The dangerous allure of Ponzi schemes lies in their exploitation of human optimism and greed. Despite numerous warnings and historical examples, people frequently fall prey to similar cons, often driven by a fear of missing out on seemingly lucrative opportunities. Understanding the operational mechanics and historical context of Ponzi schemes can be crucial in cultivating vigilance and caution. Engaging in thorough education on investment fraud can act as a defense against the allure of these deceptive ventures. Learn to identify investment scams and discover ways to prevent investment scams to shield potential investors from these cunning deceptions.

How Ponzi Schemes Operate

A Ponzi scheme, a term originating from Charles Ponzi, exemplifies the pinnacle of financial trickery, disguising itself as a genuine investment opportunity while fundamentally relying on the unstable structure of utilizing fresh investments from newcomers to deliver so-called returns to earlier participants. The advertised gains enticing investors are merely reallocations of their own cash or those from later joiners. This intricate mirage is sustained by a constant influx of new members, reminiscent of a signature characteristic of pyramid schemes.

The initiation of a Ponzi scheme generally begins with the organizer proposing investments that pledge improbably high rewards with little to no risk, an enticement hard to ignore. Early investors might actually obtain their expected payouts or returns, fostering a false sense of security and attracting more unwary individuals through enthusiastic endorsements. However, beneath this facade of profitability lies a fragile structure, ultimately heading toward disintegration due to its dependence on a perpetual recruitment cycle.

Warning signs should become apparent when returns are mainly sourced from an expanding base of investors rather than genuine business operations or effective enterprises. As the scheme enlarges, sustaining such lofty returns becomes nearly impossible, particularly when the stream of new investments dwindles. The ruse unravels as withdrawals exceed contributions, and the scheme collapses under its own burden, leaving most investors confronting significant losses.

Grasping these intricacies provides the key to identifying and evading these pitfalls. An investor must stay vigilant, understanding where their funds are placed and insisting on clarity and confirmable proof of lawful profits. For further advice on protecting one's resources against such unscrupulous maneuvers, consider exploring detailed resources that provide insights and tactics for detecting and averting financial scams. You can also discover ways to prevent investment scams to safeguard your investments effectively.

Recognizing Ponzi Scheme Red Flags

Upon venturing into the enigmatic realm of investments, one must maintain sharp vigilance, for hidden beneath the enticing charm of high profits lies the potential snare of a Ponzi scheme. These insidious financial constructs, disguised as successful ventures, frequently display defining indicators that, once uncovered, can unveil their deceitful nature.

A cardinal sign of such deception is the assurance of consistent, elevated returns with minimal risk. Authentic investment opportunities are generally susceptible to market fluctuations, and while they might yield significant gains, the intrinsic uncertainties and variable outcomes are candidly acknowledged. In contrast, a Ponzi scheme will unfailingly promise stable financial rewards, insulating itself from the harsh truths of economic fluctuations.

Further scrutiny should focus on the scheme’s operational transparency, or lack thereof. A legitimate investment mechanism will provide detailed, comprehensible information about its processes and operations. In stark contrast, Ponzi schemes often obscure the particulars of their activities, offering convoluted or ambiguous explanations that stifle enquiry under a cloak of mystery.

Moreover, the operational strategies of Ponzi schemes frequently involve an incessant focus on recruitment. The scheme prospers on a constant influx of new participants, as their funds serve as the critical source sustaining the illusion of profitability. If the opportunity seems intensely centered on expanding its investor base, often providing incentives for recruitment over the actual performance of genuine investments, prudence dictates a thorough re-evaluation of its authenticity.

Additionally, while reputable financial ventures are subject to the scrutiny and regulation of authorities, Ponzi schemes often operate covertly, evading such oversight. Their hesitance to provide reliable documentation of their compliance and adherence to regulatory bodies should trigger a prominent warning signal.

Finally, the pressure to invest, often cloaked in the form of exclusive urgent offers, is a hallmark of these exploitative endeavors. A legitimate investment will offer you the necessary respect to conduct due diligence, while a Ponzi scheme will manipulate the fear of missing out to swiftly draw you into its clutches.

In this intricate financial landscape, armed with the discernment to recognize these warning signs, one can wisely navigate and avoid the traps of Ponzi schemes, safeguarding our financial stability. For more details, Discover ways to prevent investment scams and Learn to identify investments scams.

Protecting Your Investments from Ponzi Schemes

In the ever-evolving world of financial investments, it is essential to have a keen perspective to identify genuine opportunities from deceitful ventures. Ponzi schemes, being particularly crafty, often pose as enticing investment avenues promising exceptional returns with minimal risk. To safeguard yourself from such deceptive tactics, it is crucial to devise a comprehensive strategy to protect your amassed assets.

Initially, conduct a thorough examination of any investment opportunity. Scrutinize the organization offering the investment by verifying its registration with relevant regulatory bodies. Authentic firms will usually be registered and under supervision, providing a basic level of assurance. Look into the credentials and backgrounds of the individuals involved through trustworthy sources and be wary of any inconsistencies or evasive explanations.

Discover ways to prevent investment scams.

Diversification acts as a reliable shield against financial misrepresentation. By distributing investments across various asset classes and sectors, you protect your portfolio against total loss due to fraudulent activities. This approach reduces the chance of significant setbacks if a particular investment turns out to be deceptive.

Moreover, maintain a healthy skepticism towards promises of unbelievably high returns with minimal risk. Ponzi schemes thrive on assurances of exorbitant profits that lure unsuspecting investors. Always remember, if it seems too promising, it probably is. Demand clear and thorough documentation elucidating the investment's nature, potential risks, and the business model it is based on.

Establishing a robust network with financial advisors and experienced investors can provide invaluable insights and recommendations. These individuals can often spot irregularities and red flags that might be missed by less seasoned investors. Additionally, staying informed through financial education programs and resources can enhance your ability to identify and counter fraudulent schemes.

Learn to identify investments scams.

Finally, remain alert for any anomalies after investing, such as issues accessing funds or unexplained communication delays. These could be indicators of potential fraudulent activity. In cases of suspected wrongdoing, promptly contact regulatory agencies to report the matter and seek advice on preventive actions.

By following these prudent strategies, you can effectively fortify your investments against the clever threat of Ponzi schemes. Stay informed, remain skeptical, and safeguard your financial future with vigilance and caution.

Real-life Examples of Ponzi Schemes

Throughout history, Ponzi schemes have captivated and ensnared investors with promises of exceptionally high yields and insignificant risk, ultimately leading to financial devastation for many. One of the most infamous examples dates back to Charles Ponzi himself, whose operation in the early 1920s involved international reply coupons. Ponzi assured extravagant returns by seemingly exploiting currency exchange discrepancies. At his zenith, Ponzi amassed millions of dollars from deceived investors, illustrating the enchanting allure of effortless wealth. His downfall eventually gave rise to the term 'Ponzi scheme' becoming synonymous with this type of fraud.

Jump to the latter part of the 20th century, Bernie Madoff orchestrated arguably the largest Ponzi scheme in history. Acting as a reputable investment advisor, Madoff promised steady, significant returns regardless of market changes. His scam, which spanned decades, unraveled in 2008 when investors attempted to withdraw billions they thought were theirs, revealing an astounding $65 billion deception. Madoff's fraud collapsed due to the economic downturn, highlighting the inherent unsustainability in such scams when too many people seek to recoup their investments simultaneously.

In more recent times, the case of Allen Stanford captured headlines. Stanford operated a global banking empire from Antigua, offering certificates of deposit with impossibly high-interest rates. For nearly two decades, he maintained an illusion of legitimacy until authorities uncovered his $7 billion Ponzi scheme. The opulent nature of his lifestyle and the involvement of influential individuals and celebrities added further scandal to the case.

Each of these episodes emphasizes the perilous allure of such illicit financial endeavors. They often thrive under a veneer of respectability and guaranteed success, only to reveal the deceit beneath when economic conditions shift or regulatory authorities probe too deeply. Thus, to avoid history repeating itself, these cautionary tales serve as stark reminders of the dangers inherent in the pursuit of excessive gain. For those looking to protect themselves, it's crucial to discover ways to prevent investment scams and learn to identify investments scams.