Introduction to Exit Scams

Exit scams represent a deceptive ploy often perpetrated within the financial and investment arenas, characterized by a duplicitous scheme wherein operators abscond with investors' funds at an opportune juncture. These scams manifest primarily in the domains of cryptocurrency, ponzi schemes, and failing investment platforms. Exit scams typically lure investors with promises of high returns and a façade of legitimacy, only to culminate in the abrupt disappearance of the orchestrators, leaving investors high and dry. The allure of quick and substantial financial gain, combined with the minimally regulated nature of these markets, creates a fertile breeding ground for such fraudulent enterprises.

In the context of blockchain technology, exit scams are particularly insidious due to their pseudonymous nature, which obfuscates the individual identities involved and complicates recovery efforts. The far-reaching repercussions of exit scams underscore a critical need for investor vigilance and due diligence. For those navigating the labyrinthine corridors of investment, understanding and recognizing the hallmarks of exit scams is imperative in safeguarding one's financial interests. To fortify your defenses against investment fraud, consider these Explore our investment protection strategies.

How Exit Scams Occur

Exit scams are a quintessential facet of the darker side of the digital economy. Perpetrators of these schemes often capitalize on the burgeoning interest in unregulated or loosely regulated markets, executing a carefully orchestrated plan to abscond with investors' funds. Initially, these fraudsters create a façade of legitimacy. It often begins with the crafting of a seemingly authentic business or investment opportunity that is buttressed by sleek marketing materials and an ostensible track record of success.

In many instances, the enterprises involved in exit scams operate within the realm of digital currencies or online platforms, where the nature of transactions is inherently nebulous. The perpetrators tend to employ sophisticated marketing strategies, including alluring websites replete with fake testimonials and endorsements, and even artificial liquidity to simulate an active market presence.

At the heart of their subterfuge is the cultivation of trust. Fraudsters might engage with potential investors via online forums, social media discussions, and professional networking sites to create a veneer of legitimacy and community involvement. They lure victims with promises of high returns, often exceeding what would normally be plausible in traditional investment scenarios.

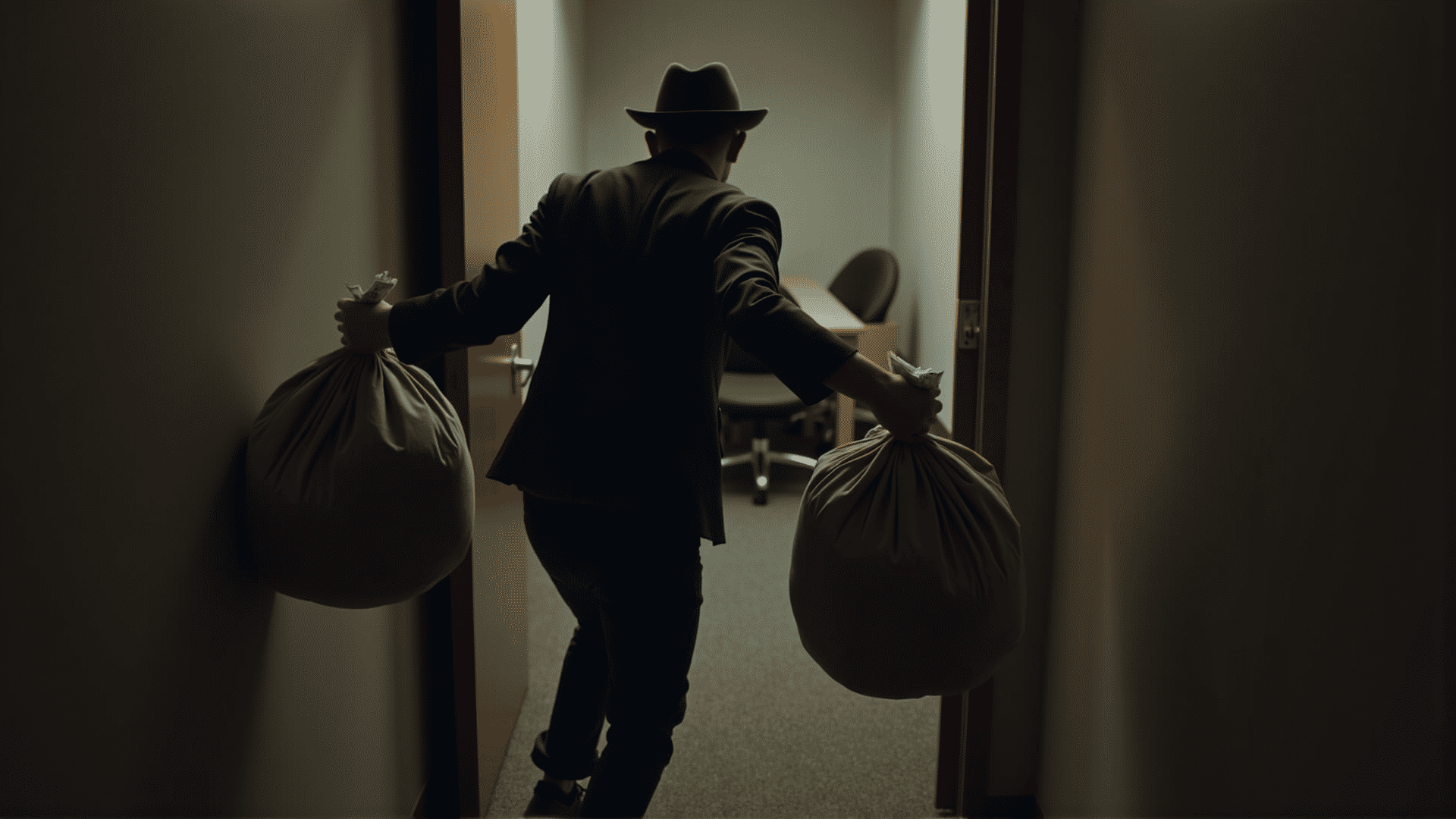

Once an adequate amount of investment has been amassed, the fraudsters execute their exit strategy, which usually involves a sudden shutdown of communications and online presence. They deactivate websites, delete social media profiles, and, in some cases, fabricate crises to explain their abrupt disappearance. The victims are left in the lurch, with the culprits vanishing into obscurity, taking the hard-earned money with them.

Drawing parallels between these schemes and traditional financial fraud, it is imperative for individuals to exercise heightened vigilance. By recognizing the red flags and remaining circumspect, potential investors can fortify themselves against such perfidious operations. For further insights, readers can explore our investment protection strategies to augment their understanding and bolster their defenses against these cunning machinations.

Identifying Red Flags

In the entangled web of financial undertakings, the specter of an exit scam looms large, deserving vigilance and discernment. One must carefully scrutinize ostensibly benign indicators that progressively reveal their deceptive nature. A recurring red flag is the abrupt cessation of communication from the investment entity or influencer who once inundated you with updates and assurances. Coupled with this is the sudden imposition of withdrawal constraints or technical "glitches," masquerading as temporary setbacks while obfuscating deeper malevolence.

Another alarming sign is the pressure to infuse additional funds under the guise of securing a lucrative return, often flagged as a promotional opportunity or exclusive offer. This tactic preys on urgency, manipulating an investor's avarice and optimism. Additionally, inconsistencies in documentation or terms that are either peculiarly opaque or shift precipitously should arouse suspicion. The language may transform into an unintelligible jargon-laden narrative that evades transparent interpretation, further ensnaring clients in a labyrinth of confusion.

Noticeably, a dearth of verifiable information about the company or its executives emerges as a cardinal indicator. Authentic enterprises exhibit an ethos of transparency whereby identities and credentials are not only accessible but verifiable. The cloak of anonymity, enveloping key personnel, starkly contrasts this ethos, signifying deceit in motion.

To the discerning investor, these signs are not standalone anomalies but interlinked threads signaling an intricate tapestry of duplicity. By remaining vigilant and critical, one can unveil the potential pitfalls and evade the quagmire of an exit scam. For an in-depth exploration of safeguarding strategies, consider consulting resources like the Guide to Prevent Investment Scams, which elucidates on effective countermeasures against such pernicious endeavors.

Strategies to Protect Investments

Navigating the precarious landscape of investments requires more than just acumen in poring over financial statements or predicting market trends. In an era where unscrupulous exit scams prey upon unsuspecting investors with alarming regularity, the need for robust protective strategies is paramount. A cornerstone of safeguarding your investments is due diligence, which transcends mere investigation into the platitudinous company website. Delve into a comprehensive examination that includes scrutinizing the credentials of key executives, tracing the lineage of the company, and corroborating their claims with independent third-party sources. Beyond the veneer of perfunctory checks, it is prudent to enlist the acumen of financial advisors and legal experts who can adduce insights that might otherwise evade your perusal.

Moreover, diversifying your portfolio acts as an intrinsic buffer, diminishing the impact of potential malfeasance. Diversification across sectors and geographies not only circumscribes your risk exposure but also obviates the peril of placing all proverbial eggs in one basket susceptible to fraudulent activity. Concurrently, leveraging technology to your advantage could serve as an impeccable deterrent against scams. This includes deploying tools designed to verify the authenticity of digital communications and utilizing platforms that offer transparent transaction histories.

In situations where engagement with a new investment opportunity looms, it is sagacious to commence with a parsimonious quantum of capital. Such a calibrated approach allows for an experiential assimilation of the setup's authenticity without imperiling substantial assets. Concomitantly, remain vigilant towards red flags indicative of potential scams: unvetted promises of high returns, pressure tactics demanding hasty financial commitments, opaque operational details, and a conspicuous absence of regulatory compliance documentation are admonitory signals to heed with caution.

Adhering to these stratagems buffers investors against the capriciousness of exit scams, facilitating a secure and fruitful investment trajectory. For further guidance on preemptive measures against investment fraud, consider exploring our comprehensive investment protection strategies.

Case Studies of Exit Scams

In the shadowy realm of digital and financial deception, exit scams stand as a particular blight, often ensnaring the unwary and undermining trust within various communities. These scams typically manifest when operators of illicit or semi-legitimate ventures abscond with users’ funds, abruptly shuttering operations and leaving participants stranded. By delving into real-world case studies, we can unearth the profound ramifications these schemes have on socioeconomic landscapes.

Consider the disquieting case of the cryptocurrency platform, BitConnec—to date, one of the most notorious exit scams in digital currency lore. Promoters lured investors with exorbitant promises of returns, allegedly guaranteed by a proprietary algorithm. However, as scrutiny intensified and regulatory bodies began closing in, the operators plunged into the digital abyss, vanishing alongside approximately $2 billion in investor capital. The repercussions were manifold; not only did individuals suffer severe financial losses, but confidence in emerging blockchain technologies was also destabilized, prompting a more stringent regulatory oversight that still ripples through today's decentralization narratives.

On the fringes of the darknet, the Silk Road Marketplace saga provides another eerie chapter on the litany of exit scams. Originally an online marketplace cloaked in anonymity and notoriety, it offered everything from illicit substances to counterfeit currencies. However, as authorities gradually untangled its operations, the marketplace's sudden deployment of an exit scam left users in disarray, their balances irretrievable. This breakdown sowed mistrust among darknet users, catalyzing a wave of hostile fragmentation and rendering future transactions fraught with apprehension and paranoia.

The ubiquity of these scams transcends digital markets, occasionally infiltrating realms considered secure by traditional standards. The Southern Cross Group, a South American investment enterprise, drew infamy when its upper echelon orchestrators discreetly siphoned assets before vanishing, leaving investors grappling with overwhelming losses. This event underscored the pervasive vulnerabilities even in perceived secure investment corridors and led to increased scrutiny and legislative frameworks aimed at safeguarding investor interests.

By dissecting these intricately orchestrated scams, we discern patterns, such as the allure of guaranteed returns and the specter of anonymity that fuels these illicit enterprises. Moreover, understanding these cases helps illustrate the criticality of vigilance and due diligence in financial interactions. While innovations and opportunities expand, the specter of exit scams serves as a sobering reminder of the due care needed to protect one's ventures. For further insights on how to safeguard against such treacheries, one might explore our investment protection strategies. As history has shown, informed scrutiny is an invaluable ally against the capricious tides of financial deception.